The accruals and deferrals are regulated in the HGB and accordingly there are items of active and passive accruals in almost every balance sheet . In this post we will show you when they arise, how they work and what special cases there are. Of course, we also inform you about the booking of prepaid expenses and the corresponding offsetting entries in the respective period, the resolution of the talk booking records the following year.

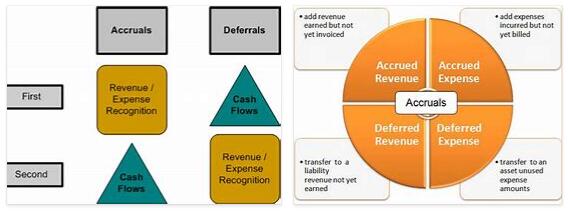

Accruals and deferrals – function and definition

The fiscal years or the company’s period are not always exactly the same as the calendar year for all companies. For example, if a company was founded in May, the fiscal year will be different from the calendar year. There is a so-called “short year” because the financial year is not a full calendar year.

Now, however, there is the principle of “accounting according to the accounting period”. This means that only expenses and revenues may be taken into account that can be allocated to the respective fiscal year or period under consideration. Accruals and deferrals are used to solve precisely this dilemma . In a sense, they enable the correct allocation and delimitation of expenses and revenues , even if fiscal years differ from calendar years.

Active and passive accruals and deferrals

A distinction is made between two types of accruals, namely active and passive accruals. The distinction between these two variants is easy:

- With active accruals and deferrals (aRAP for short), amounts are paid that not only consider the current financial year, but also the next financial year. This is traditionally the case, for example, when insurance or the rent is paid in advance for a year. In this case, the aim of deferred income is to determine which part of the amount paid is due to the current financial year and which part is to be related to the next financial year.

- The deferred income is exactly the opposite. This concerns situations in which customers have already made payments, which, however, not only affect the current financial year, but actually only generate income after the balance sheet date . A typical example here is when a software license is purchased that is valid for one year and therefore part of the amount is only added later.

Calculation and booking

The calculation of those amounts that can be allocated to another year is easy. It simply has to be determined proportionally which part of the amount has to be posted in which year. The business case is then posted.

For example, if an insurance premium of over € 1,000 has been paid, only half of which is attributable to the current financial year, the normal posting with the entire amount takes place first:

Insurance premiums | Bank, € 1,000

It is then determined that € 500 can be allocated to another fiscal year. Therefore, a corresponding accrual must be made. This is thus assigned:

Active accruals and deferrals | Insurance contributions, € 500

In the next year, this booking record will then be canceled again by making an offsetting entry, i.e.:

Insurance premiums | Active deferred income, € 500

At this point in time, the business case is finally closed through the dissolution of aRAP.

Input tax deduction with active accruals

The input tax deduction is 100% in the year in which the payment is made. Thus, nothing is divided or separated in the tax amount, but the input tax deduction can be made very easily.

Provisions and other liabilities and receivables

Just restoring lungs are keeping getting a little touchy subject. So here in this case too. A precise distinction must be made as to whether it is a provision, other liabilities or receivables or prepaid expenses (RAP).

- Provisions exist if the service is provided in the current year, but the expense is not yet known and, accordingly, no payments have yet been made.

- In the case of other liabilities and receivables , the amount is already known, but no payments have yet been made, for example because there is a correspondingly long payment term.

- On the other hand, with active accruals and deferrals, the payment should have already flown, but part of it should be attributable to the next financial year.

Special cases: interest and discount

A special case exists when, for example, a loan is taken out. The loan amounts to 100,000 euros, but there is a discount of 2,000 euros – so only 98,000 euros are paid out.

The accounting department now has the option of posting these 2,000 euros as interest expenses. The alternative is to work with accruals and deferrals. In this case, 2,000 euros are posted for active accruals and then the respective portion is reversed year after year, for example a tenth, i.e. 200 euros, for a loan period of 10 years. The annual offsetting entry is then always:

Interest expense | active accruals, € 200

With this approach, the 2,000 euro discount is correctly mapped over the entire credit period in the accounting and dissolved proportionally year after year.

Conclusion on active accruals and deferrals

The accruals and deferrals, which are stipulated accordingly in the HGB, ensure that all values are assigned to the correct periods. Above all, it is important to distinguish between active accruals and accruals. If active accruals are made, the correct amount must be determined and the necessary offsetting entry must be made in the following year in order to dissolve the item.

The advantage of active accruals and deferrals is that these are often items that arise again and again, such as insurance. When you close the position, you can check whether a new posting may be necessary again in this financial year.