The XRechnung will be introduced throughout Germany and will not only affect state institutions, but also particularly companies that have to submit invoices to state agencies. We therefore took a close look at how the new format works, what advantages it brings and what pitfalls there are.

XRechnung – definition

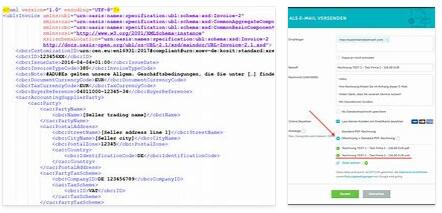

The basic idea behind the XRechnung is that it replaces the invoices in paper form and also moves the PDF format into the past. The aim is to establish a new standard. The core of XRechnung is a structured exchange of data records in a uniform format that enables automated further processing.

XRechnung – General information about the new format

The XRechnung is necessary because entrepreneurs could not automatically process the PDF files previously sent. The XRechnung is also supposed to finally stop sending invoices by post. This also has a positive impact on the environment and there is potential for savings for accounting companies. The XRechnung should on the one hand increase efficiency and on the other hand contribute to making invoicing more secure overall .

The new format enables entrepreneurs to process the transmitted data automatically thanks to the uniform standards. This can best be compared with the familiar XML files, which can also be transmitted via interfaces. The XRechnung is now being introduced in stages and in future all invoices must be submitted to the federal government in this format.

XRechnung becomes mandatory – time schedule

At the moment it is still the case that only the federal government or its institutions have to hurry. Some of the new systems have already been introduced, and by autumn 2019 all federal authorities will finally switch to the new X-invoices. All other authorities will follow suit by mid-April 2020 . Then federal suppliers are also affected. That means all those companies that currently still send invoices to the federal government or authorities in other ways or in other formats. The deadline is November 27, 2020. However, countries can set different deadlines. Companies should deal with the change in good time and take the appropriate measures.

EU standards for XRechnung

One of the central goals of XRechnung is standardization. The EU wants digital invoices to be used throughout the Union and these should be structured as uniformly as possible so that they can be processed efficiently.

To make this possible, there are specific guidelines on how the core elements of digital invoices must be structured. This is to ensure that even if different systems are used within the EU, they generate data that are compatible with one another. These requirements thus represent the framework, while the individual member states are free to decide on the specific implementation. Ultimately, the systems should meet the requirements and be compatible with each other. All states had more than enough time to implement suitable systems, because the guideline was published in 2014 – now it only needs to be implemented at national level.

What to watch out for when converting to XRechnungen

The changeover to the new format will not be underestimated for the companies affected. It is therefore important to plan this process well, to communicate the new adjustments and then to implement them in good time.

Clarify the current situation

As a first step, companies should analyze the current accounting process. It sounds banal at first, but if you outline the exact, actual process, you have a good starting point for the next steps.

Description of the target state

Based on the established current situation, it is now defined how the future processes must be so that the new requirements are met. In addition, companies must clarify how they can best set up and arrange the processes in order not to meet the standards with the new XRechnung.

Involve employees to create acceptance

Accounting processes in particular are often well-established, well-established processes. Changes in this familiar area are always tricky. It is therefore absolutely essential to actively involve employees in the redesign of the processes. In concrete terms, this means that the persons concerned should not simply be presented with a finished concept of how it should work in the future. Rather, all those affected should be involved right from the start, even when recording the existing processes.

This reveals the disadvantages of the current approach. In the change process, the new processes should therefore also be developed with the involvement of the employees, for example through workshops.

The acceptance of the new processes in the workforce is extremely important for the successful implementation. Especially with such complex change processes, companies have to make sure to keep an eye on the human component and get everyone on board.

Involve IT providers

If inhous lacks the necessary expertise for the changeover, companies can access external IT providers. They help design new processes and provide the necessary infrastructure.

Practical example of the use of XRechnung

The typical use case of XRechnung is given when companies want to invoice services provided to the federal government, for example. The new system ensures that all steps in this allocation are always carried out uniformly and are clearly structured. The XRechnung ensures that the entire process in the performing company and also at the invoice recipient can run digitally without paper.

After the XRechnung has been sent, the following steps are also accelerated. The federal government processes the XRechnungen automatically and thus the payment is made faster. A clear advantage for the performing companies, because the rapid processing improves the liquidity situation.

Benefits of electronic invoices

At first glance, the XRechnung sounds like a bureaucratic matter, but anyone who takes a closer look at it quickly realizes that the XRechnung also have advantages for the companies concerned.

Cost and time savings

Once the processes have been optimized and renewed, the first savings effects take effect. It is no longer necessary to print invoices. This not only requires less paper and toner, but also saves on envelopes. It also extends the life of the existing printer. Expensive new purchases are postponed due to the small amount of printed pages.

There is also a significant time saving for employees . No more striking printers, no paper jams and no more hassle with empty toner.

Better liquidity

In addition to cost and time savings, the XRechnung also improves the liquidity of the accounting company. The simple reason for this is that the XRechnungen can be sent faster and are delivered immediately – there is no need for post. The automated processing means that payment is made quickly, which has a positive impact on liquidity .

Space saving

Another factor that should not be underestimated is the space savings. The invoices do not have to be stored in paper form. This means that fewer folders are required and the storage space can be reduced accordingly.

No media breaks

Probably the biggest disadvantage of previous accounting methods has always been the media discontinuity. Create an invoice on the PC, then print it out to draw it by hand, for example, then send it by post … All these processes in which digital and analog media were mixed are a thing of the past with XRechnung. The result should also be that the susceptibility to errors decreases and thus less post-processing time is required.

XRechnung as an alternative to ZUGFeRD

The previous ZUGFeRD system , which has been used for electronic invoicing in recent years , has only recently been renewed. In general, there was quite a bit of disagreement about which system should be used in the future and which way is the right alternative from a technological point of view. Ultimately, the XRechnung has now clearly established itself as the new standard, although the ZUGPFeRD 2.0 system also meets the requirements of the XRechnung.

Nevertheless, it is clear that in the future there will be no way around the XRechnung.

Conclusion and outlook – so it goes on

The XRechnung is the model of the future. Especially for medium-sized and larger companies, which also often send bills to the federal government or its institutions, this results in a considerable amount of effort for the conversion of the previous processes. In addition to technical expertise, good process and change management is particularly important here in order to ensure the necessary acceptance of XRechnung within the company.

Due to the current deadlines, there is still enough time as a company to react to the new requirements. It is important that companies start the transition in good time. In addition, they can get help from IT and tax experts, so that a problem-free, seamless transition to XRechnung takes place.